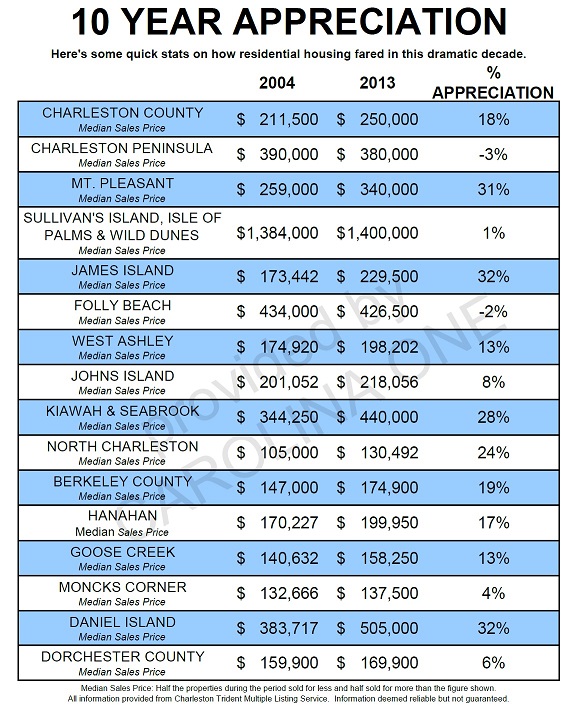

In a decade that saw enormous real estate appreciation and also a historic slow down, it’s important for buyers and current homeowners to take a step back and consider large scale trends in our Charleston real estate market. This final chart compares the median sales price in 2004 to 2013 and gives the percentage of appreciation for each of the main areas.

Because we work with a lot of local real estate investors (and invest in the market ourselves), we know that real estate offers one of the highest returns on investment over a long period of time. This is partly because of its leveraging power. For example, let’s say that an investor has $30,000 in cash and is weighing the options of stocks, real estate, mutual funds, etc. If he or she were to put this money into a mutual fund, for example, only that $30,000 would get the power of appreciation.

However, if he/she were to use this money towards a down payment and closing of an investment property, that $30,000 initial amount would benefit from appreciation on a $110,000 condo. In other words, a Mount Pleasant investor in the past 10 years has enjoyed a 31% return on a $110,000 condo even if he/she has only spent $30,000 so far on the mortgage. This increased potential return on the investment (combined with tax write offs) gives many investors a historically strong option for diversifying funds.