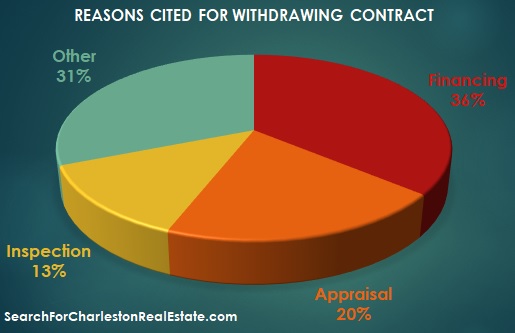

Over 2,300 Realtors recently took part in a study that examined the causes of fallouts for real estate contracts. We’ve included here the most common reasons that contracts fall apart along with tips to keep your closing on track.

Financing: 36%

Thirty-six percent of Realtors in the study cited financing as the cause for their ratified contract not making it to the closing table. To avoid falling into this trap, home buyers should talk with a lender before they start seeing homes. Many buyers think that their credit is better than it actually is, or they have mistakes in their credit report that can be easily fixed, or their self-employed status makes their income difficult to track, or their debt puts them just outside of the magic debt-to-income ratio. Talking with a lender and taking the time to get him/her the necessary paperwork should be a top priority. There is no sense in risking your earnest money or looking at homes that you simply can’t get approved for.

Once you’ve gotten your pre-approval, make sure to follow your lender’s guidelines so that you don’t jeopardize your good status. For example, quitting a job or buying a new car can make the difference between closing on a home or not.

Appraisal: 20%

Realtors cited that one-fifth of contract fall out was due to appraisal issues. In a strong seller market where prices are going up quickly, it’s very common for a home to appraise for a lesser amount than the buyer and seller agreed to in the contract. The most frustrating part of this issue is that the home is usually truly worth the contract price based on buyer demand, but appraisals use statistics going back to 5 months (usually older, lower prices). We also see problems with appraisals when a small or non-local bank uses an out-of-town appraiser not familiar with our Charleston, SC market. Another problem is that appraisers are so overloaded with work this year (due to record sales) that they often don’t take the time to conduct a proper appraisal.

One of the best ways to avoid this problem is to work with a local lender. For example, our in-house Carolina One Mortgage uses only local appraisers, and we Realtors find that we have fewer appraisal issues with their appraisers.

Inspection: 13%

Both home inspections and CL-100 inspections (which look at termite damage, wood rot, and moisture levels) are common issues that can derail a contract. In this particular study, thirteen percent of Realtors cited this as the cause for fall out. However, I think in our local market that has higher than average humidity and milder winters (that usually help to control termite activity), this number would be higher.

A CL-100 has to be cleared (meaning damage has to be repaired or replaced) before a lender can close on a home. This means that if buyers are getting a mortgage, the problems have to be fixed. However, home inspection issues tend to fall into a grayer range. Some buyers view the repair request list as second round negotiations meaning that they want every item that shows up on the home inspection report addressed. However, sellers are not required to replace torn window screens, for example, or bring their electrical box up to code to current building standards when the home is fifty years old. It’s important to talk with your Realtor about creating a fair and realistic repair request list if your inspection yielded no show stoppers like structural issues. Otherwise, buyers risk falling into this 13% of homes that fell out of contract due to inspections.