Renting vs. Buying a Home

Posted by Lee and Katherine Keadle on Wednesday, February 15th, 2017 at 3:41pm.

In many cities around the country right now, it’s actually more expensive to rent than it is to own a home. For example, Charleston recently had one of the biggest quarter over quarter rent increases in the country. Because rental listings are in such high demand, landlords are able to up the rent price by several hundred dollars when it’s time to renew the lease. We’re seeing required lease periods of two or more years, and still these homes are getting rented out within days of being listed.

According to the Charleston MLS (Multiple Listing Service), the median rent price is $1,795 per month. Compare this to the median sales price of $240,000. Using a mortgage calculator, you’ll see that even with a low 3.5% down payment, the monthly mortgage payment with principle, interest, PMI, and taxes is about $1,471 – substantially less than the median monthly rent cost. This is why we’re currently seeing so many investors buying rental properties in Charleston. Many other U.S. cities are also experiencing this favorable housing market for owners.

Comparing the Pros and Cons of Renting and Buying

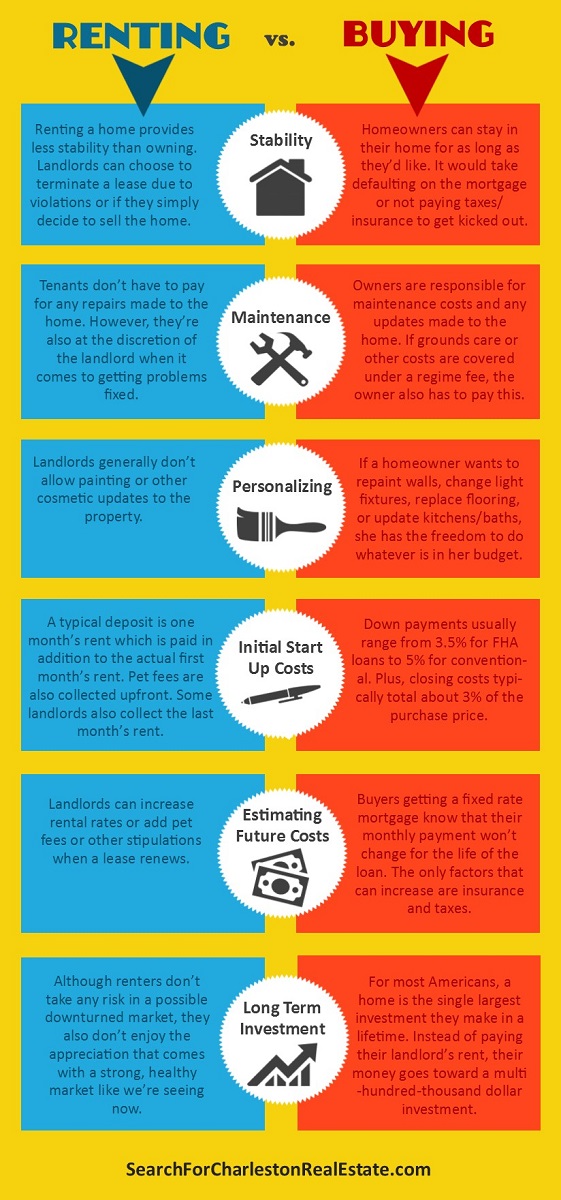

We’ve created this infographic to help compare renting and buying when it comes to these factors:

- Stability: Buying a home provides much more stability than renting.

- Maintenance: If the cost and responsibility of maintaining a home is overwhelming, you should probably rent. Although you’re relying on the landlord to fix problems on his time frame, at least you don’t have to pay for these repairs.

- Personalizing: Renters generally can’t make any changes to the property, so if you’re picky about wall colors and kitchen finishes (and you have the budget), purchasing will allow you to make the house feel like home.

- Initial Start Up Costs: Purchasing a home comes with plenty of initial out-of-pocket costs. For example, if you buy a $150,000 home with an FHA loan, you can estimate a down payment of approximately $5,250 plus about $4,500 in closing costs. The good news is that most sellers are willing to pay for some of your closings costs, which essentially finances these costs so that you don’t have to part with so much cash at closing.

- Estimating Future Costs: Whether you’re buying or renting, it’s hard to predict future costs. A renter always has to pay the going rental rate, and this is a tough pill to swallow in a city like Charleston where real estate prices are increasing at a historic rate. However, a tenant is only responsible for the rent and has no out of pocket expense for repairs or catastrophic events such as flood or fire. On the other hand, a homeowner is responsible for all of these costs, but at least his monthly mortgage payment remains more stable. Taxes and insurance will gradually increase over the years, but if you have a fixed rate mortgage then the principle and interest will never change.

- Long Term Investment: Owning a home is essentially forcing yourself to invest the money that you would have otherwise spent on rent. In other words, you can either pay your own mortgage or your landlord’s.

Another factor to consider is the flexibility of having pets since some landlords don’t allow pets in their property. In a rental market like Charleston’s where there’s already a shortage of available properties, having to find a pet-friendly home only further narrows the list of options. For the landlords who allow pets, a pet deposit is usually collected upfront, and he’ll decide whether the deposit is refundable or not. Or, we also see homeowners who tack on a monthly pet fee to the rent.

So Should I Rent or Buy?

As Realtors and long time investors in Charleston, of course we view homeownership as an important factor in building personal wealth because we’ve seen firsthand the financial and personal benefits. However, there are also plenty of reasons to rent instead of buying. If you’d like to talk about your options, contact your Realtor. Together with a trusted lender, you can compare the costs depending on the mortgage type that best fits your financial situation.